colorado springs sales tax rate

80 higher compared to the April 2021 collections or an increase of 88 830. Multiply the vehicle price after trade-ins but before incentives by the sales tax fee.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

This rate includes any state county city and local sales taxes.

. Localities that may impose additional sales taxes include counties cities and special. On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements. You can print a 82 sales tax table here.

This is higher in certain areas where Special. Year - to - date sales tax collection is 30. April 2022 sales use and accommodation tax report.

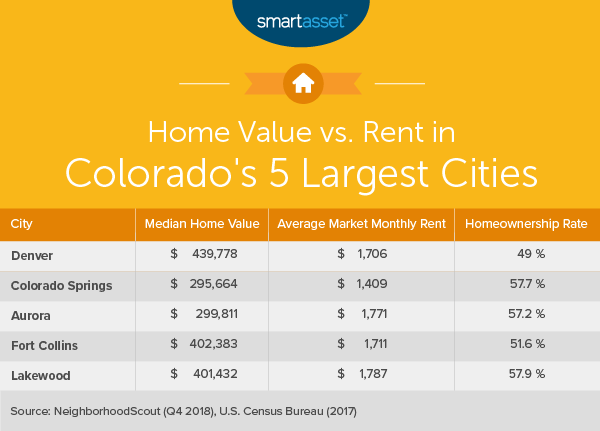

Colorado Springs CO 80903. Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Colorado Springs totaling 535. Groceries and prescription drugs are exempt from the Colorado sales tax.

If you owe additional tax return the completed form and check payable to The City of Colorado Springs Sales Tax PO Box 1575 Mail Code 225 Colorado Springs CO 80901-1575. Please call the office to determine the cash deposit amount before mailing. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8.

The license fee is 2000. Sales Taxes In the Colorado Springs area sales tax is 825. The April 2022 sales taxes for the City of Steamboat Springs are 4.

5 Food for home consumption. This is the total of state county and city sales tax rates. The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax.

The combined amount is 820 broken out as follows. To calculate the sales tax on your vehicle find the total sales tax fee for the city. The state sales tax rate in Colorado is 2900.

The Colorado Springs sales tax rate is. The city has published the preliminary. In Colorado localities are allowed to collect local sales taxes of up to 420 in addition to the Colorado state sales tax.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. The Colorado sales tax rate is currently. 3 Cap of 200 per month on service fee.

The Colorado Springs Sales Tax is collected by the merchant. Colorado Springs Sales Tax Rates for 2022. Property taxes are the main source of revenue for schools in Colorado.

How to Calculate Colorado Sales Tax on a Car. The following forms are provided for reference. With local taxes the total sales tax rate is between 2900 and 11200.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. If you have overpaid your tax return the. I plan on having a garage sale.

If you have more than one location you must file each location separately in the Revenue Online service. Colorado has 560 special sales tax jurisdictions with local sales taxes in. Average Sales Tax With Local.

For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 29. What is the sales tax rate in Colorado Springs Colorado. You can find more tax rates and allowances for Colorado Springs and Colorado in the 2022 Colorado Tax Tables.

Property Taxes Property taxes vary a lot based on where you live. 719 385-5291 Email Sales Tax Email Construction Sales Tax. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

With local taxes the total sales tax rate is between 2900 and 11200. Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. I report my gross and net taxable sales for my primary and subsidiary locations by using a schedule C when I file taxes.

290 Is this data incorrect Download all Colorado sales tax rates by zip code. Forms DR 1002 DR 0800 DR 0100. The December 2020 total local sales tax rate was 8250.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Colorado Springs does not currently collect a local. There are a total of 276 local tax jurisdictions across the state collecting an average local tax of 4075. 4 Sales tax on food liquor for immediate consumption.

Colorado has recent rate changes Fri Jan 01 2021. 85 more than year to date through the same period. Additional questions can be answered by contacting the Sales Tax Department at 719 385-5903.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Method to calculate Colorado Springs sales tax in 2021. The County sales tax rate is.

1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. Did South Dakota v. GENERALLY we plan for property taxes to be roughly 075 of the market value of the home.

Our mailing address is. 2020 rates included for use while preparing your income tax deduction. For tax rates in other cities see Colorado sales taxes by city and county.

Sales Tax Division PO. The average sales tax rate in Colorado is 6078. When you use Revenue Online to file taxes the online form includes all the tax rates for each of your business locations.

2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County. The minimum is 29. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county sales tax a 312 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

The latest sales tax rate for Colorado Springs CO. Lowest sales tax 29 Highest sales tax 112 Colorado Sales Tax. Box 1575 Colorado Springs CO 80901-1575.

Sales Tax Information Colorado Springs

Colorado Sales Tax Rates By City County 2022

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Colorado Springs Cuts 20 Million From Budget Enacts Local Government Hiring Freeze Krdo

The Cost Of Living In Colorado Springs In 2022 Rent Com Blog

How Colorado Taxes Work Auto Dealers Dealr Tax

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Business Sales Use Tax License Littleton Co

The Most And Least Tax Friendly Major Cities In America

Colorado Property Tax Calculator Smartasset

2021 Tabor Refund Colorado Springs

Neighboring Businesses Complain Scheels All Sports Is Getting Breaks At Their Expense News Gazette Com

The Cost Of Living In Colorado Springs In 2022 Rent Com Blog

Colorado Springs At 150 Years Colorado Springs Resisted Ku Klux Klan Amid Rising Tide In Colorado News Gazette Com

Minnesota State Taxes 2021 Income And Sales Tax Rates

The Cost Of Living In Colorado Smartasset

The Cost Of Living In Colorado Springs In 2022 Rent Com Blog